Personetics provide personalized insights to regional bank customers partners with Japan’s leading innovator in digital banking, iBank

Personetics’ financial data-driven customer engagement platform will help create a more digitalized banking experience for iBank’s regional bank partners

FUKUOKA, Japan--(뉴스와이어)--Personetics, the leading global provider of financial data-driven personalization and customer engagement solutions for financial institutions, today announced a new partnership with iBank Marketing Co., Ltd., a subsidiary of Fukuoka Financial Group and widely recognized as Neobank in Japan. By adding Personetics’ capabilities to its offerings for regional banks, iBank with the support of TIS, a leading systems integrator in Japan, intends to help more of Japan’s regional banks move to the digital space and bring a digitalized banking experience to more Japanese bank customers.

iBank is one of Japan’s most innovative Neobank, with a mission to enhance customers’ daily lives with digital banking services. As a subsidiary of Fukuoka Financial Group (FFG), one of Japan’s largest regional banks, iBank will work with Personetics in a B2B2C (Business-to-Business-to-Consumer) business model to partner with other regional banks in Japan. By partnering with Personetics and TIS, iBank intends to help its Japan regional bank partners offer advanced hyper-personalization capabilities, but without requiring individual deployments from the other banks.

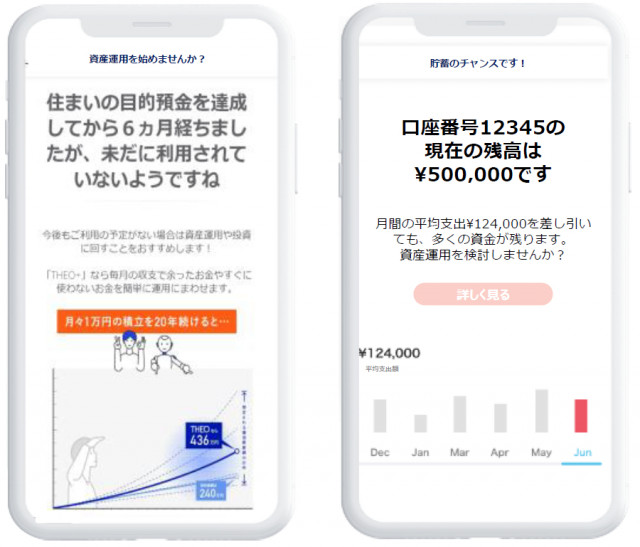

Personetics provides financial data-driven personalization for banks and financial institutions through its real-time artificial intelligence (AI) solutions. By cleansing, enriching, and analyzing customer financial transaction data, Personetics helps banks get a clearer view of how their customers manage money. By working with Personetics, banks can create personalized insights, relevant recommendations, and product-based advice to help improve their customers’ money management and financial wellness - for example, by setting smart budgets, creating financial goals, and saving more money automatically.

“We are excited to partner with FFG and iBank, who have always been at the forefront of digital innovation in Japan,” said Mr. David Sosna, CEO & Co-founder of Personetics. “By bringing Personetics data enrichment and personalized engagement capabilities to iBank’s regional bank partners, we can open new opportunities for Japan’s regional banks to support their customers. We can help Japan’s regional banks offer personalized engagement, based on their own customers’ financial transaction data. We can work together to create the future of digital banking with better money management, relevant financial advice, helpful product recommendations, and other solutions such as smart budgets and savings recommendations to make people’s financial lives better.”

Financial institutions also drive business impact from Personetics solutions by delivering an enhanced customer experience for higher customer engagement, better customer satisfaction, and more effective cross-sell targeting to help the institutions issue loans and open new accounts.

For more information, please visit Personetics.com.

About iBank Marketing Co., Ltd.

iBank Marketing Co., Ltd. is a subsidiary of Fukuoka Financial Group, Inc. (FFG). Widely recognized as Neobank in Japan., iBank has a mission to create innovative financial services. The company’s core product app, Wallet+, has been downloaded more than 2 million times. FFG also created and launched Minna Bank in 2021, the first Digital bank in Japan, that is targeted at digital natives; Minna Bank won several industry awards in 2021. iBank helps regional bank partners to deliver a more digitalized experience for Japan’s bank customers. Learn more at https://www.ibank.co.jp/.

About TIS Inc:

TIS Inc., a member of TIS INTEC Group, is a business partner to more than 3,000 companies in various sectors, including finance, industry, public services, and distribution services. It provides IT to support growth strategies, tackling various management challenges faced by its customers. Leveraging the industry knowledge and IT development capabilities it has cultivated over more than 50 years, TIS aims to realize a prosperous society by providing IT services that have been co-created with society and customers in Japan and the ASEAN region.

About Personetics

Personetics is the global leader in financial data-driven personalization, customer engagement, and advanced money management capabilities for financial institutions. Focused on enabling proactive engagement for banks, Personetics’ AI analyzes financial data in real time to understand customer financial behavior, anticipate customer needs and deliver a hyper-personalized experience. We are creating the future of “Self-Driving Finance,” where banks can proactively act on their customers’ behalf to help improve their financial wellness and achieve financial goals.

Our industry-leading data analytics solutions harness customer financial transaction data to provide day-to-day actionable insights, personalized recommendations, product-based financial advice, and automated financial wellness programs. Financial institutions use Personetics’ agile solutions to rapidly create their own personalization IP to serve the unique needs of their customers and differentiate themselves in the market. With Personetics offerings, financial institutions transform their digital banking experience into the center of the customers’ financial lives.

We offer solutions for mass market consumer banking, SMB banking, wealth management, and credit card issuers. Personetics drives business impact for financial institutions by improving relevant product targeting for accurate, efficient cross-selling and upselling. We help financial institutions deepen their customer relationships, increase core deposits and customer retention, expand share of wallet, and boost Customer Lifetime Value.

Personetics currently serves over 80 financial institutions spanning 30 global markets, reaching 120 million customers. We are backed by leading venture capital and private equity investors, with offices in New York, London, Tel Aviv, Singapore, Tokyo, Paris, Spain, and Australia.

Learn more at personetics.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20220713005097/en/